Real games to win real money – Welcome to the world of real games where you can win real money! In this comprehensive guide, we’ll delve into the exciting realm of legitimate online gambling, exploring reputable platforms, game types, payment methods, responsible gaming practices, and tax implications.

Get ready to unlock the secrets of real money gaming and embark on a thrilling journey filled with endless possibilities.

Whether you’re a seasoned pro or a curious newbie, this guide will equip you with the knowledge and strategies you need to navigate the world of real money gaming confidently. So, buckle up, grab a drink, and let’s dive right in!

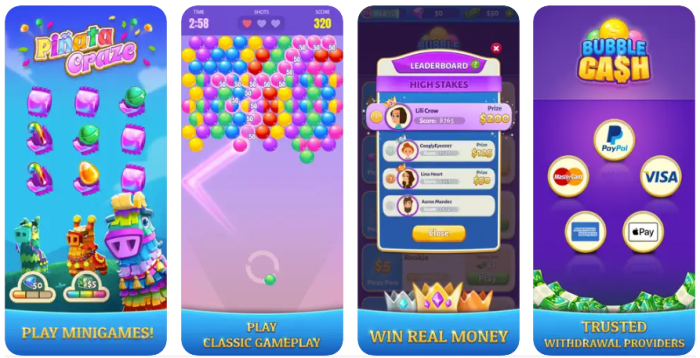

Withdrawal and Payment Methods

Understanding the various withdrawal and payment methods offered by real money gaming platforms is crucial. Each method has its own processing times, fees, and security features, so it’s essential to choose the one that best suits your needs.

Common withdrawal and payment methods include:

Bank Transfers

- Reliable and secure method, but can take longer to process (1-5 business days).

- Typically involve no fees, but your bank may charge a small fee.

- Suitable for large withdrawals and deposits.

E-Wallets

- Offer fast and convenient transactions (usually processed within 24 hours).

- May incur small fees for withdrawals and deposits.

- Provide additional security measures, such as two-factor authentication.

Cryptocurrencies

- Growing in popularity due to their anonymity and low transaction fees.

- Processing times can vary depending on the cryptocurrency and network congestion.

- Security is generally high, but it’s important to choose reputable exchanges and store your cryptocurrencies securely.

Prepaid Cards, Real games to win real money

- Offer convenience and anonymity, but may have limited withdrawal options.

- Typically involve higher fees compared to other methods.

- Suitable for small and medium-sized transactions.

Security Considerations

When choosing a withdrawal or payment method, it’s important to consider security aspects:

- Use reputable platforms with strong encryption and security measures.

- Enable two-factor authentication for additional protection.

- Be cautious of phishing emails or websites that may attempt to steal your login credentials.

Responsible Gaming and Player Protection: Real Games To Win Real Money

Responsible gaming and player protection are crucial aspects of real money gaming platforms. These measures aim to prevent and mitigate the potential risks associated with gambling, ensuring a safe and enjoyable experience for players.

Real money gaming platforms implement various measures to promote responsible gaming and player protection, including:

Self-Exclusion Options

Self-exclusion options allow players to voluntarily exclude themselves from accessing a gaming platform for a specified period. This feature is designed to help individuals who may be struggling with gambling-related issues to take a break from gaming.

Deposit Limits

Deposit limits allow players to set limits on the amount of money they can deposit into their gaming accounts. This helps to control spending and prevent excessive gambling.

Age Verification

Age verification measures are implemented to ensure that minors are not able to access real money gaming platforms. These measures typically involve verifying a player’s age through identification documents or other means.

Tax Implications of Real Money Winnings

Winning real money from gaming platforms can be an exciting experience, but it’s essential to be aware of the potential tax implications. The tax laws governing gaming winnings vary depending on your jurisdiction, so it’s crucial to understand the specific rules that apply to you.

In many jurisdictions, gaming winnings are considered taxable income. This means that you may need to pay taxes on the amount you win, depending on your tax bracket and other factors. It’s important to consult with a tax professional to determine the exact tax implications for your situation.

Tax Laws in Different Jurisdictions

- United States:In the US, gambling winnings are subject to federal income tax. The amount of tax you owe will depend on your tax bracket and the amount you win.

- United Kingdom:In the UK, gambling winnings are not taxable, regardless of the amount you win.

- Canada:In Canada, gambling winnings are taxable, but you can claim a deduction for any gambling losses you incur.

Final Thoughts

As we conclude our exploration of real games to win real money, remember that responsible gaming is paramount. Always gamble within your limits, set deposit limits, and seek help if needed. With a responsible approach and a dash of luck, real money gaming can be an exhilarating and potentially rewarding experience.

We hope this guide has provided you with the insights and strategies you need to embark on your real money gaming journey. May your spins be lucky, your cards be favorable, and your winnings be substantial. Good luck, and remember to play responsibly!